Building a Solid Internal Control System for Your Startup: Safeguarding Financial Integrity

As your startup grows, ensuring the accuracy and reliability of your financial information becomes increasingly important. This is where internal controls come into play. Internal controls are the systems and procedures a business puts in place to safeguard its assets, ensure the accuracy of financial records, and prevent fraud or error. For startups, establishing a strong internal control system early on is essential to protect the business and create a foundation for sustainable growth.

What Are Internal Controls?

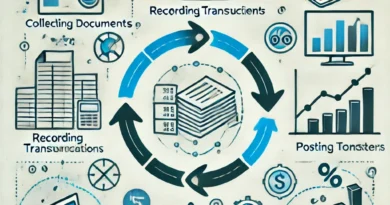

Internal controls are policies and procedures designed to ensure that your startup operates efficiently, accurately records financial transactions, and complies with legal requirements. They help prevent mismanagement, fraud, and errors while providing transparency to investors, creditors, and other stakeholders.

Internal controls can be broken down into two main categories:

1. Preventive Controls: Designed to stop errors or fraud from occurring in the first place, such as requiring multiple approvals for large purchases.

2. Detective Controls: These identify errors or fraudulent activities after they have occurred, such as regular audits and reconciliations.

Key Components of an Internal Control System

For startups, implementing a robust internal control system can be challenging but crucial to long-term success. The following components are essential to building a strong internal control framework:

1. Segregation of Duties

One of the most effective internal controls is separating key financial duties among different employees. By ensuring that no single person has complete control over all aspects of a financial transaction, you reduce the risk of fraud or errors. For example, the person who authorizes payments should not be the same person who records them.

2. Authorization Procedures

Set up clear rules for who has the authority to approve different types of transactions. This includes setting limits on who can authorize purchases, approve payroll, or sign checks. Requiring multiple levels of approval for larger transactions adds an extra layer of security.

3. Physical Controls

Physical controls help protect tangible assets such as inventory, cash, and equipment. Examples include locking cash in a safe, using security cameras in storage areas, or limiting access to warehouses. For digital assets, this might involve password protection, encryption, or restricted access to sensitive financial data.

4. Reconciliations

Regularly comparing internal financial records with external documentation, such as bank statements or supplier invoices, helps catch discrepancies early. Reconciliations should be done at least monthly to ensure that financial records remain accurate.

5. Regular Audits

Audits are a detective control that helps identify weaknesses in your internal control system. While startups may not need a full audit early on, regular internal reviews of financial records can provide valuable insights into areas for improvement and help identify potential issues before they become serious problems.

6. Documentation and Recordkeeping

Keep detailed and accurate records of all financial transactions. This includes maintaining receipts, invoices, contracts, and other relevant documentation. A clear audit trail makes it easier to trace the source of any discrepancies and supports transparency in financial reporting.

Why Internal Controls Are Essential for Startups

Startups often operate in environments with rapid growth, tight cash flow, and limited staff, making them more vulnerable to fraud, errors, or mismanagement. Implementing a solid internal control system helps ensure:

Financial Accuracy: Controls help prevent and detect errors, ensuring that your financial statements are accurate.

Fraud Prevention: Segregation of duties and authorization procedures reduce the risk of fraud by ensuring no one person has control over the entire financial process.

Investor Confidence: Investors are more likely to trust a startup with a strong internal control system, as it demonstrates responsibility and reduces the risk of financial mismanagement.

Compliance: Internal controls help ensure that your startup complies with legal and regulatory requirements, such as tax laws and financial reporting standards.

Implementing Internal Controls in a Startup

For startups, implementing internal controls may seem daunting, but it’s possible to scale your control system as the business grows. Begin with the basics—segregation of duties, authorization procedures, and regular reconciliations. As your startup expands, gradually introduce more comprehensive controls like audits and physical asset protection measures.

Final Thoughts

Building a solid internal control system is critical for protecting your startup’s financial health and ensuring long-term success. By implementing preventive and detective controls, segregating duties, and maintaining accurate records, you can safeguard your assets, prevent fraud, and ensure the integrity of your financial statements.

#InternalControls #StartupFinance #FraudPrevention #BusinessSecurity #FinancialManagement #ProBizInsights #SegregationOfDuties #FinancialAccuracy #AuditControls #StartupGrowth