Mastering Bookkeeping and Accounting Basics for Startups

Effective financial management is the backbone of any successful startup. Whether you’re just starting or scaling your operations, having a solid grasp of both bookkeeping and accounting is essential for maintaining the financial health of your business. Understanding the differences between these two functions and how they work together can help ensure that your startup runs smoothly, stays compliant, and makes informed decisions.

The Difference Between Bookkeeping and Accounting

While they are often used interchangeably, bookkeeping and accounting serve different roles. Bookkeeping involves the daily recording of financial transactions—everything from sales and expenses to payroll. It’s the foundation that accounting builds upon. Accounting, on the other hand, is the process of summarizing, analyzing, and interpreting this financial data to create meaningful reports. These reports are used for making key decisions, tax filings, and tracking overall financial performance.

For startups, effective bookkeeping is crucial in ensuring that all transactions are recorded properly. This allows accountants to generate accurate financial reports, which are necessary for evaluating the company’s performance and attracting investors or securing loans.

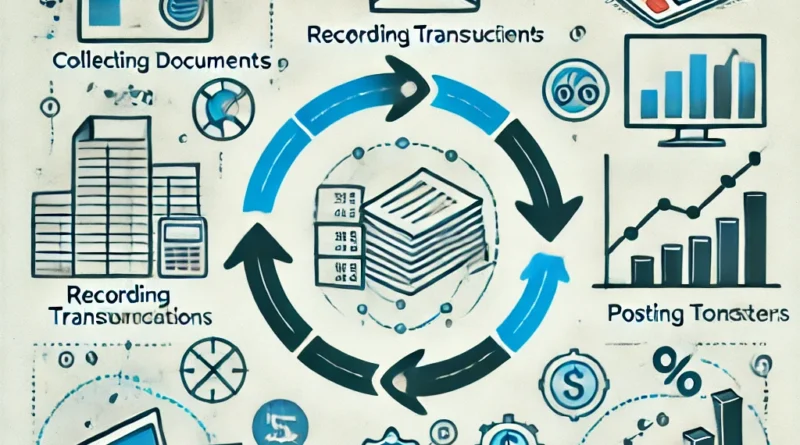

The Accounting Cycle

The accounting cycle is the step-by-step process that ensures your financial data is captured accurately. It begins with collecting and organizing source documents such as invoices, receipts, and contracts. From there, transactions are recorded in journals, posted to ledgers, and ultimately summarized in financial statements. For startups, keeping this process tight helps avoid common financial pitfalls and ensures that tax obligations are met.

Some key steps in the accounting cycle include:

- Recording Transactions: Every financial activity, from sales to expenses, needs to be documented.

- Posting to Ledgers: Transactions are categorized into specific accounts to give a clear picture of your company’s financial position.

- Generating Financial Statements: Reports like balance sheets and income statements are created to summarize the company’s financial health.

The Fundamental Accounting Equation

A critical concept for all startups is the accounting equation:

Assets = Liabilities + Equity.

This equation ensures that your financial records are balanced, which is crucial for generating accurate reports. Assets represent what the company owns, liabilities are what the company owes, and equity is the owner’s interest in the company. Every transaction your startup makes will impact this equation.

For example, when you purchase equipment, your assets increase, but so does your liability if you’ve financed it. Maintaining this balance ensures you can always see where your company stands financially.

Why This Matters for Startups

Startups often operate with limited cash flow and a high level of uncertainty. That’s why staying on top of your finances from the beginning is vital. Accurate bookkeeping ensures you can track where your money is going, while proper accounting helps you understand your company’s profitability, cash flow, and financial trajectory.

For a startup looking to scale or attract investors, having clean financial records is non-negotiable. It helps you present your business as reliable and well-managed, increasing your chances of securing funding or investment.

In conclusion, mastering bookkeeping and accounting basics is an investment in the longevity and success of your startup. By keeping detailed records and understanding how to analyze your financial data, you can make informed decisions, remain compliant, and set your business on a path to sustainable growth.

#AccountingForStartups #BookkeepingEssentials #SmallBusinessFinance #FinancialManagement #StartupSuccess #BusinessGrowth #ProBizInsights #FinancialHealth #CashFlowManagement #BusinessAccounting